Ark Bedrock Mortgage Fund

Superior returns and proactive risk management.

Current return to investors

11.10% p.a.

Minimum investment

$50k

Distributions Paid

Monthly

Loan-To-Value Ratio

64.20%

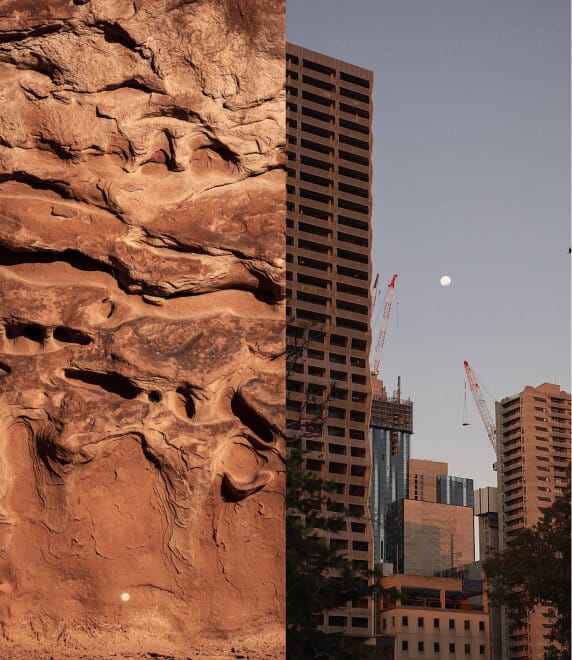

The Ark Bedrock Mortgage Fund delivers investors secured, attractive returns from a spread of investments in trusted Ark Wholesale Fund loans. Launched in December 2023, Bedrock’s returns have consistently outperformed its RBA Cash Rate + 5.0% target.

Fund Details

Type & Structure

Pooled Diversified Mortgage Fund

Unregistered managed investment scheme

Ark Capital Funds Limited is the Trustee

Investment schemes

Registered Mortgage only

Minimum 85% 1st mortgage and cash

Targeted average LVR of 65%, maximum average LVR 75%

Targeted returns net of fees of RBA Cash Rate + 5.0% p.a. plus

Investments sourced from available Ark Wholesale Mortgage Fund investments

Distributions paid monthly

Distribution reinvestment available

Redemptions available quarterly

Investors

Minimum investment of $50,000

Only available to investors who qualify as a ‘wholesale’ investor under the Corporations Act 2001; or invest $500,000

Key Metrics

– April 2025

Loans

23

Borrowers

18

Average LVR

64.2%

Average loan maturity

7MO

Loans in arrears

NIL

Prepaid interest loans

100%

Funds under Management

$71.2m

Unit holders

208

Historical Returns

– April 2025

Investment Sectors

– April 2025

Geographic Location

– April 2025

Loan Type/Purpose

– April 2025

Borrower Exposure

– April 2025

FAQs for NewInvestors

Ark Capital offers a range of investment opportunities, including real estate, private equity and debt investments. Our focus is on high-growth sectors and investments with strong potential for returns.

Ark does not provide personal advice and recommends that investors receive their own legal and financial advice before investing.

The minimum investment amount varies depending on the specific opportunity. Typically, our minimum investment starts at $50,000. Specific details can be provided during your consultation with our investment team.

Returns vary depending on the type of investment and market conditions. Historically, our portfolio has delivered competitive returns, however, it’s important to remember that all investments carry risks, and past performance is not indicative of future results.

We employ a rigorous due diligence process, including thorough market analysis, risk assessment and continuous monitoring of investments. Our experienced team works diligently to mitigate risks and protect investor capital.

Investors receive monthly statements detailing the performance of their investments. Additionally, we provide annual summaries and keep investors informed of market trends and portfolio updates as the investment progresses.

All our investments have specific conditions for withdrawal of investment funds as outlined in the relevant Information Memorandum. Redemption options depend on the specific investment agreement. For example, the Bedrock Fund has a 6 month lock-in period while facilities under the Wholesale Fund typically have a minimum loan term of 12 months.

Fees vary depending on the investment type but generally include management fees and cost recoveries. Detailed fee structures are provided during the investment consultation process.

All returns offered to investors are net of fees and without deduction

Yes, Ark Capital is regulated by the Australian Securities and Investments Commission (ASIC) and the holder of Australian Financial Services Licence (AFSL 476209). We adhere to strict regulatory standards to ensure our compliance with regulatory requirements in our investment activities.

You can contact us via phone, email, or through our website’s contact form. Our team is available to answer any questions and provide support throughout your investment journey.

A Wholesale client refers to the meaning given in Section 761G of the Corporations Act 2001 (Cth). For investments less than $500,000, investors will need to provide an Accountant’s certificate issued by a qualified Accountant. Upon reviewing the Applicant’s financial position, the Accountant will certify that the investor can demonstrate either:

– Net assets of at least $2.5million; or

– A gross income for each of the last two financial years of at least $250,000 a year

Available on the following platforms

You can access the Ark Bedrock Mortgage Fund via the Mason Stevens wealth platform or Netwealth wealth platform. These trusted investment platform allows you to manage and keep track of all your investments in one place.

For a high-performing fund, invest in Bedrock

Get in touch with the Ark Capital team today to learn more about diversifying your portfolio with Bedrock.

Phone

"*" indicates required fields

Stay in the know for investment opportunities

Subscribe to the Ark Capital newsletter to receive all the latest updates and investment opportunities to expand your wealth.

"*" indicates required fields

We respect privacy and will never share your identity