Commercial real estate debt (CRED): Is it worth the risk?

Asset-backed and unlisted securities can be challenging to monitor and value. And that’s precisely why investors need to understand the distinctions between different private credit strategies.

Real estate debt, with its tangible security and transparent valuation process, offers a compelling alternative to these more complex approaches. Critics, however, have argued that the private credit sector needs tighter regulation. However, this overlooks the substantial oversight already in place.

The framework for responsible lending exists – we've been operating within it successfully for years.

As a private credit manager, Ark Capital holds an Australian Financial Services License (“AFSL”) issued and administered by ASIC, operating Managed Investment Schemes in accordance with the Corporations Act and regulated by ASIC, and complies with AML/CTF regulations administered by AUSTRAC. We undergo a statutorily required and independent annual AFSL audit, and our funds undergo independent annual financial audits. In addition, we maintain an independent risk and compliance committee.

Our strategic focus? Residential and industrial sectors.

This isn’t by accident. Land and land subdivision projects in particular offer shorter investment terms and lower construction risk compared to large-scale development projects. When combined with our extensive experience in development and construction, this helps us manage risk effectively while delivering consistent returns for our investors.

Our message is simple: not all private credit is created equal.

By focusing on real estate debt, maintaining high transparency standards, and sticking to our core expertise, we’re demonstrating how private credit can deliver value to both borrowers and investors while still maintaining robust risk management standards.

Article written by Peri Macdonald, Chief Executive Officer – View LinkedIn

The commentary in this article in no way constitutes a solicitation of business or product advice. It is expressed solely as the opinion of the author, and as general information for the reader. It is not information to be relied upon in making investment decisions.

Navigating Bias and Finding Your Voice as a Female Leader

From being talked over in meetings to having ideas attributed to others, navigating these obstacles can feel isolating.

But every challenge presents an opportunity to grow. Every setback can pave the way for stronger, more authentic leadership.

Throughout my career, I’ve faced my share of biases and setbacks. However, these experiences have taught me invaluable lessons about authenticity, confidence and the importance of owning my voice.

Recognising and overcoming bias

One of the earliest challenges I encountered was recognising the subtle forms of bias that exist in professional working environments. Being labelled as “too assertive” one moment and “too soft” the next happened all the time! I often felt like I was walking a tightrope—trying to strike a balance that often seemed out of reach.

I realised that biases—both implicit and explicit—weren’t always about me but about perceptions shaped by societal norms. The key was not to internalise these judgments… but to rise above them.

To navigate biases, I focused on:

- Preparation: Backing my arguments with data and clear evidence to establish credibility.

- Understanding the audience: Tailoring my approach based on the dynamics of the room.

- Speaking up strategically: Choosing the moments to assert my presence to make sure my voice was heard.

Finding your authentic leadership style

At the start of my career, I believed I needed to emulate the dominant leadership styles around me to succeed. I tried speaking louder, challenging ideas assertively and even conforming to traditional moulds. But these behaviours felt inauthentic and left me feeling disconnected from my true self.

Over time, I realised that authenticity is a strength, not a weakness. By embracing my natural leadership style—one grounded in empathy, active listening and collaboration—I found that I could lead with confidence while staying true to my values.

If you struggle to find your groove as a leader, here are some practical steps you can take to start embracing your authenticity:

- Know your strengths: Identify what makes your leadership style unique and lean into those qualities.

- Stay consistent: Authenticity requires alignment between your words, actions and values.

- Seek feedback: Honest input from trusted colleagues or mentors can provide clarity and validation.

Building confidence in a male-dominated industry

Confidence doesn’t always come naturally, especially when you’re one of the few women in the room. Like many others, I’ve struggled with self-doubt, especially wondering if my ideas were valuable or if my voice mattered.

The turning point for me came when I reframed confidence not as an inherent trait but as a skill to be developed. I began to rely on preparation, mentorship, and small, incremental wins to build my confidence over time.

Here’s how you can do the same:

- Be prepared: Take action! Confidence often comes from building competence. The more prepared you are, the more assured you’ll feel.

- Find mentors and allies: Surround yourself with people who champion your success and offer honest advice, be they teammates or your industry peers.

- Practice self-compassion: Allow yourself room to learn and grow rather than striving for perfection.

The power of networking and community

One of the most transformative decisions I made was committing to building a network of like-minded professionals. Initially, I avoided networking, finding it intimidating to approach strangers at events. But by setting small, achievable goals—like attending events solo or introducing myself to one new person at a time—I slowly built a robust network that has become a cornerstone of my success.

Networking has opened doors, fostered meaningful connections, and provided a support system that makes the journey less isolating.

If you’re hesitant about networking, remember:

- Every connection starts with a single conversation.

- Authenticity is your biggest asset—people value real interactions.

- A strong network is not just about opportunities; it’s about creating a support system for shared growth.

Women in leadership: your voice matters!

Biases, setbacks and self-doubt are not the end of the story—they’re stepping stones. By embracing authenticity, building confidence and cultivating a strong network, you can navigate these challenges with grace and resilience.

Article written by Anita Young, Chief Financial Officer – View LinkedIn

The commentary in this article in no way constitutes a solicitation of business or product advice. It is expressed solely as the opinion of the author, and as general information for the reader. It is not information to be relied upon in making investment decisions.

Private credit vs. traditional lending: 7 key differences investors should understand

When you’re investing, understanding the differences between private credit and traditional lending is essential for navigating today’s dynamic financial landscape. Both options provide funding solutions, but they serve different needs and operate under distinct frameworks.

Here, we unpack the seven key differences to help you evaluate the potential benefits of private credit in Australia’s dynamic financial market.

1. Source of funds

Traditional lending, primarily offered by banks relies heavily on deposits. Banks pool customer savings and use these funds to extend loans, adhering to strict regulatory frameworks.

Conversely, private real estate credit is provided by non-bank entities such as private funds, asset managers and investment firms (like Ark Capital). These entities source capital from investors, superannuation funds or institutional clients, allowing them to operate with greater flexibility in loan structuring.

In Australia, the private credit market has grown to an estimated AUD $40 billion, representing about 2.5% of total business debt. This reflects its appeal as an alternative funding source amid tighter banking regulations.

2. Loan structures and flexibility

Private credit is characterised by bespoke solutions. These loans often include customised terms, making them ideal for borrowers with unique or complex financial needs such as real estate developers. Traditional lenders, on the other hand, offer standardised products that may not accommodate specific borrower requirements.

For investors this flexibility translates to opportunities for higher returns. Private credit investments typically yield 8% to 12% annually, outperforming returns from many traditional fixed-income assets.

3. Speed and accessibility

Private credit transactions are often faster and more accessible for borrowers compared to traditional loans. This is because investment firms like ours can bypass the bureaucracy and internal fixed lending parameters of banks, while still assessing and mitigating risk. This speed is especially valuable for real estate or time-sensitive deals, where quick access to capital can be critical.

Meanwhile, traditional lenders often require extensive documentation and layered approvals which can delay funding. This efficiency in private credit makes it attractive to borrowers.

4. Risk and security

Private credit can involve higher risk because it often caters to borrowers with non-traditional credit profiles including startups or companies undergoing restructuring. However, this risk is mitigated by mechanisms such as senior loans secured by registered mortgages and other security.

In contrast, traditional lenders favour borrowers with robust credit histories and stable financials, limiting exposure to defaults. While this conservatism reduces risk it also caps potential returns for investors. Notably, the default rate for private credit loans is around 2.3%, significantly lower than high-yield corporate bonds, which hover around 5.8%.

5. Regulatory environment

The regulatory frameworks for private credit and traditional lending differ significantly. Banks must adhere to strict regulations including capital adequacy requirements and reserve ratios. These safeguards ensure financial stability but limit the flexibility banks can offer in their lending products.

Private credit operates outside these constraints which allows for innovative financing solutions. However, this also means fewer consumer protections compared to bank loans, making due diligence crucial for investors and borrowers alike, which is something we take very seriously at Ark Capital in addition to deeply active investment management.

One notable example occurred in April 2023 when a developer defaulted on a loan. Guided by our deeply active investment management approach, we stepped in early, working closely with the borrower to ensure the project’s completion. This hands-on involvement protected investor capital, delivered full repayment of the loan and all accrued interest, including an additional 500 basis points in penalty interest.

At Ark, we do more than monitor, we work diligently to turn challenges into outcomes. Our goal is to preserve value and maintain momentum for our investors and we do this by always managing risk decisively.

6. Correlation with markets

Private credit offers diversification benefits due to its low correlation with public equity and bond markets. For investors this provides additional stability of income in volatile economic conditions. For instance, private credit has maintained higher returns with lower volatility compared with major stock indices, helping to buffer portfolios against downturns.

7. Market trends

The private credit market globally is experiencing rapid growth, including in Australia. This growth is driven by a combination of factors including

- tighter banking regulations post the global financial crisis

- the rise of middle-market borrowers seeking alternative financing, and

- increasing investor demand for high-yield opportunities.

Private credit and traditional lending each serve important roles

For investors, private credit offers something different including higher return potential, income diversification and access to a growing, dynamic market.

As always, the right opportunities require deep expertise and active risk management. At Ark Capital, we specialise in exactly that.

Curious how private credit could work for your portfolio? Get in touch to explore your opportunities.

Unlocking Potential: Private Credit for Real Estate Developers

While traditional bank financing has long been the default choice, private real estate debt has emerged as a compelling alternative, offering greater flexibility, faster approvals, and a more tailored approach.

Four key advantages of private real estate debt for developers

At Ark Capital, we have seen firsthand how private real estate debt unlocks opportunities that conventional lenders often overlook. Unlike many private credit funds, we pride ourselves on being more nimble, with faster decision-making processes that enable developers to act with confidence. Based on my experience, here are four reasons why private real estate debt could be the right choice for your next project.

1. Flexibility in financing structures

One of the key advantages of private credit is its ability to offer tailored solutions. Traditional banks impose rigid lending criteria, often limiting developers ability to structure deals that reflect the specific nuances of their projects. Private credit providers, in contrast, customise loan terms, repayment schedules, and covenants, ensuring funding solutions that align with project-specific needs.

2. Speed and certainty of execution

In real estate, timing is everything. Lengthy approval processes can derail promising opportunities, particularly in competitive markets. Private credit funds, particularly Ark Capital, operate with streamlined decision-making and a hands-on approach, enabling developers to secure funding in weeks rather than months. This certainty allows developers to move quickly on acquisitions and execute their projects with confidence.

3. Higher leverage for enhanced returns

Private real estate debt often provides higher leverage than traditional banks, financing up to 75-85% of a project’s total development cost. This reduces the equity contribution required from developers, ultimately enhancing returns. For those developers looking to scale or diversify their portfolios, this level of funding flexibility can be a significant advantage.

4. Filling the funding gap

Regulatory constraints have led many banks to retreat from real estate lending, particularly in more complex or non-standard projects. Private credit fills this gap by financing projects that, while strong in fundamentals and return potential, may not meet traditional bank risk models.

Looking ahead to 2025

With the Australian property market remaining dynamic, access to fast, flexible capital will be crucial to driving growth. As traditional lenders remain cautious, private real estate debt is not just an alternative, it is a strategic advantage for ambitious developers.

At Ark Capital, we pride ourselves on our ability to move quickly and decisively, providing developers with certainty and speed when it matters most. If you’re looking for a funding partner who understands real estate and can adapt to market demands, let’s connect or read up on our lending solutions here.

Article written by Zak Fennell, Head of Origination & Execution – View LinkedIn

The commentary in this article in no way constitutes a solicitation of business or product advice. It is expressed solely as the opinion of the author, and as general information for the reader. It is not information to be relied upon in making investment decisions.

Resilience & Leadership in the Property & Finance Sector: Lessons from a Journey

In the property and finance sectors, resilience often involves navigating unique challenges, breaking barriers, and continuously adapting to an ever-evolving industry.

Through my career journey, spanning two decades across diverse roles, I’ve learned that cultivating resilience, adaptability and emotional intelligence is not optional—it’s essential.

Here, I share some of the lessons that shaped my path and insights I hope will inspire you, especially if you’re a woman in finance.

The role of resilience in leadership

Early in my career, I believed that success required a rigid approach to leadership. This looked like assertiveness at all costs and emulating the dominant behaviours around me. However, I soon realised that true leadership is far more nuanced.

Resilience gave me the strength to face rejection, adapt when my ideas were dismissed and keep going even when progress felt slow.

For example, in one of my roles, I passionately presented an idea only to see it knocked back by the team. When the same concept was presented by a colleague and taken on, I didn’t give up. Instead, I doubled down on preparation and used data-backed arguments to strengthen my voice.

In my experience, building resilience involves:

- Shifting your mindset: View obstacles as opportunities for growth rather than roadblocks.

- Seeking support: Don’t hesitate to ask for mentorship or feedback. These connections can provide invaluable guidance.

- Celebrating small wins: Even small milestones are worth recognition; they fuel your drive (especially on tough days).

Adapting in a fast-paced industry

The property and finance landscape evolves rapidly, shaped by economic shifts, new regulations and advancements in tech. Staying relevant requires adaptability and it isn’t solely about embracing change: you have to anticipate it.

During my career, I’ve made it a habit to stay informed—whether through reading industry reports, diving into self-improvement books, or learning from colleagues’ experiences.

One notable lesson came when I questioned a decision to diversify a company’s operations into an unfamiliar area. Though my caution wasn’t heeded at first, the eventual pivot validated my concerns.

To stay adaptable:

- Invest in continuous learning and professional development.

- Keep an open mind about new approaches, technologies and market trends.

- Prioritise simplicity and focus (Steve Jobs is a great example here).

Emotional intelligence is your superpower as a leader

In leadership, particularly in high-stakes, competitive spaces, emotional intelligence (EQ) can be the deciding factor between being a good leader and a great one. EQ isn’t just about understanding emotions; it’s about leveraging them to foster collaboration and empathy.

Some strategies I’ve adopted include:

- Active listening: Taking the time to truly hear and understand team members’ perspectives.

- Pausing before reacting: This small habit can transform potentially tense situations into opportunities for growth.

- Building a positive culture: As I often remind my team and myself, “There are no problems, only solutions.”

Your strengths as a woman are an asset

Resilience, adaptability and emotional intelligence are not innate—they are skills that can be developed with time and intention. By embracing these qualities, we can not only navigate the complexities of the property and finance sectors but also create a legacy of impactful leadership.

As women, our strengths—empathy, authenticity and the ability to adapt—are assets. Let’s harness them to push boundaries and pave the way for future leaders.

Article written by Anita Young, Chief Financial Officer – View LinkedIn

The commentary in this article in no way constitutes a solicitation of business or product advice. It is expressed solely as the opinion of the author, and as general information for the reader. It is not information to be relied upon in making investment decisions.

Navigate the Noise of Private Credit

While some managers deservedly face scrutiny, there’s a tendency to paint the entire sector with a broad brush, characterising its growth as a sign of market exuberance or inadequate regulation.

At Ark, we maintain that this narrative misses the mark. Private credit is already a well-regulated industry, and the true differentiator between managers isn’t regulatory compliance but investment methodology and discipline.

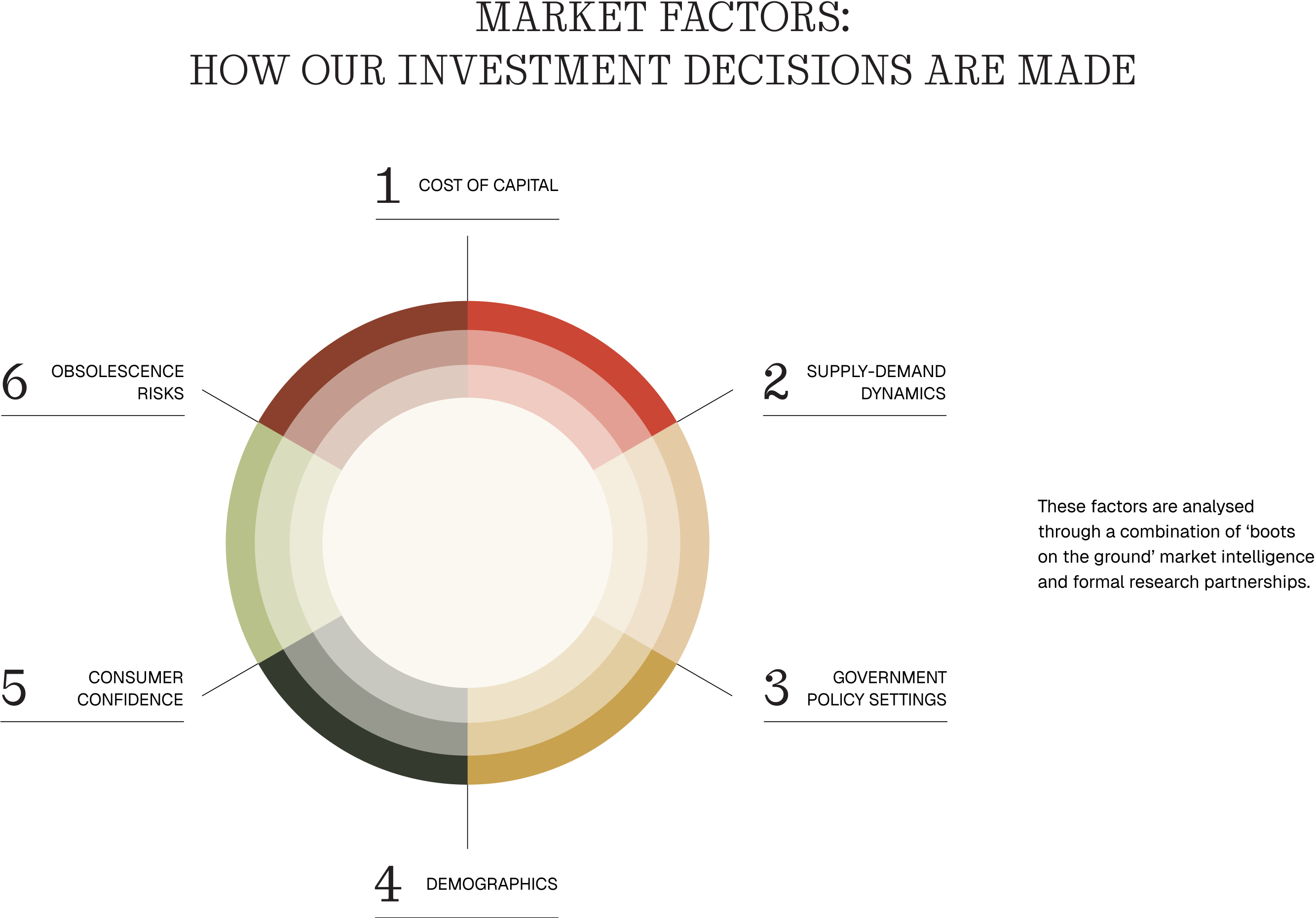

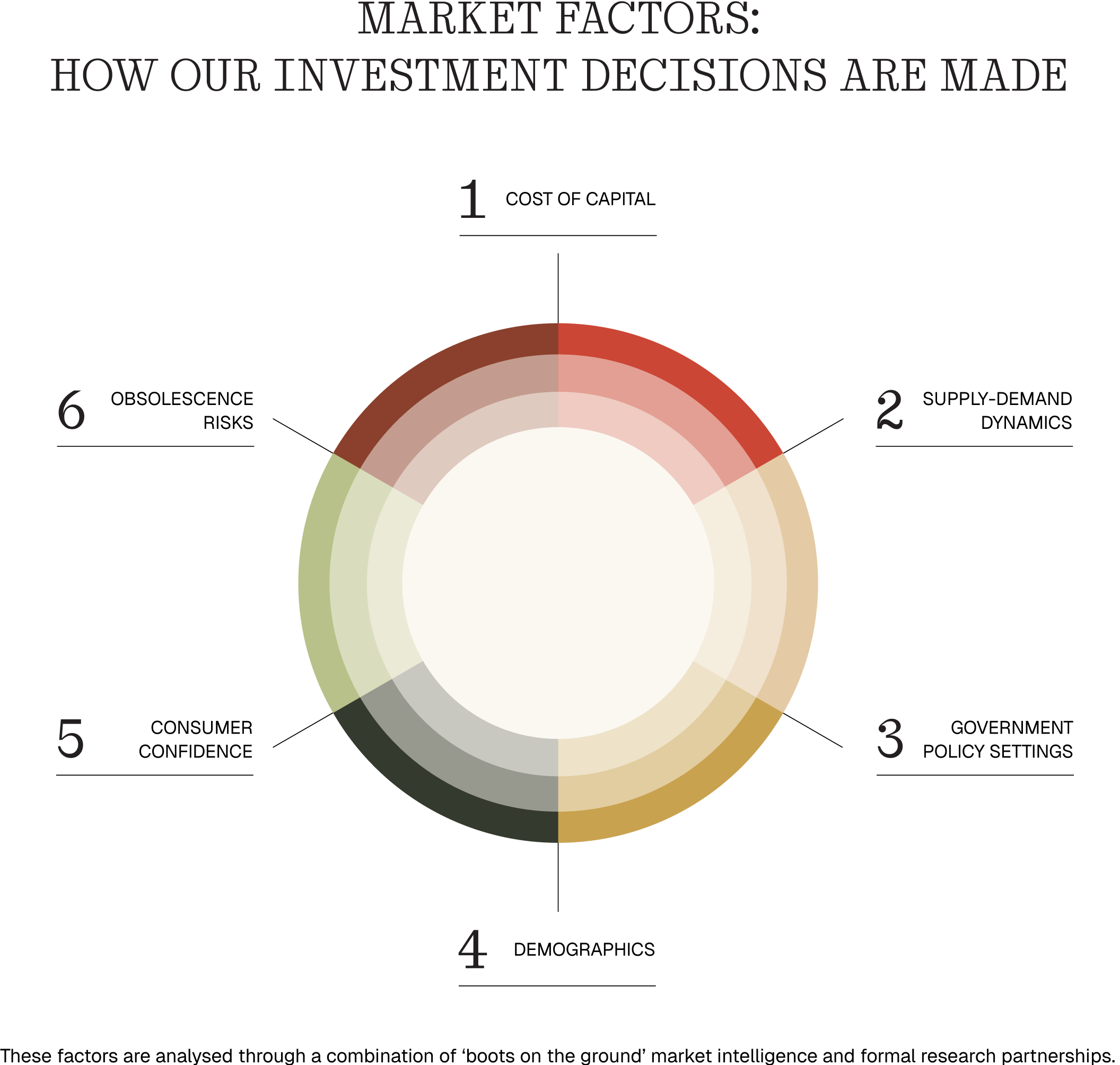

Our Directional Analysis Approach

For over a decade, we have employed a distinctive approach to market analysis that focuses not on market timing but on identifying directional changes across different regions and sectors.

The crucial question isn’t whether market conditions are good or bad but whether they’re improving or deteriorating. This methodology drives the firm’s investment decisions across its portfolio of residential, commercial and industrial assets.

The Ark approach examines multiple market factors, including cost of capital trends, supply-demand dynamics, government policy settings, demographics, consumer confidence and obsolescence risks. This analysis is supported by both on-the-ground market intelligence through the firm’s Origination team and a formal research partnership with Urbis, producing bi-annual market outlooks that inform investment decisions.

Strategic Avoidance of High-Risk Sectors

One notable example of Ark’s methodology in action has been the firm’s strategic avoidance of large-scale built form construction projects for the past four years. This decision was driven by analysis of post-pandemic factors including disrupted global supply chains, government stimulus through housing construction incentives, increased government infrastructure spending, significant wage increases, inflation and rising interest rates.

These factors led to considerable construction cost escalation with two critical impacts: existing projects under construction suffered major cost blowouts and program delays, threatening financial viability, while new major projects became unviable, putting significant downward pressure on land values. In Melbourne alone, land values for major development sites have fallen by 20-30% over the last 12-18 months.

Ark identified these risks early through its market analysis approach. This allowed us to pivot our investment strategy toward land and land subdivision opportunities where fundamentals remained strong.

Regional Differentiation

Our analysis has also identified divergent opportunities across Australian residential markets, with Southeast Queensland, Adelaide and Perth showing strong growth patterns while Sydney remained flat and Melbourne experienced headwinds.

Despite Melbourne’s positive fundamentals including population growth and restricted supply, the market has faced challenges from government policy, taxation settings and declining consumer confidence. Meanwhile, Southeast Queensland has benefited from affordability advantages, strong economic fundamentals and momentum building ahead of the 2032 Olympics.

Over the last four years, our focus on quality residential land investments in Brisbane, Adelaide and Western Australia has delivered consistent results, with investments generally performing on or ahead of schedule and meeting or exceeding targeted returns.

Governance as a Competitive Advantage

Ark’s risk management framework provides additional safeguards through:

- A multi-layered approval process through separate investment and credit committees with independent members and no overlapping membership

- A Risk and Compliance Committee with a majority of independent members, including the Chair

- Monthly reviews of every investment through an Investment Management Committee, identifying issues as they emerge.

This governance structure ensures the disciplined execution of the firm’s investment strategy across all market conditions.

Experience as Prevention

A distinctive aspect of our approach is how we leverage our team’s deep experience in property investment and development. While some competing fund managers highlight similar experience—particularly their ability to manage developments when debt positions convert to equity investments—we believe they miss a crucial point.

The real value of experience isn’t in managing problematic investments after they’ve gone wrong but in preventing those failures in the first place. This preventative approach has helped us avoid failed investments so that investors can have confidence when they invest in a debt facility it will remain as debt and wont covert to equity.

Proven Results

Our Bedrock Mortgage Fund is really a proxy for our investment strategy. It invests in a diversified portfolio of mortgages and continues to deliver net returns exceeding 11.0% p.a. from a portfolio with an average LVR of 62.7%. As of February 2025, the portfolio consists of 25 investments diversified across our favoured markets, heavily weighted toward residential land and civil construction loans.

These results reflect the effectiveness of the firm’s methodology-driven approach in identifying opportunities that others miss while avoiding sector-specific risks.

Looking Ahead

As market conditions continue to evolve, we remain committed to our systematic approach to market analysis. We focus on directional changes rather than absolute conditions, combined with strong governance structures and a preventative mindset to deliver consistent returns for investors in an environment where many private credit managers face challenges.

For investors seeking to cut through the noise surrounding private credit, Ark offers a compelling alternative—one built on strategic methodology, not marketing. Avoid the noise and get in touch today.

Article written by Peri Macdonald, Chief Executive Officer – View LinkedIn

The commentary in this article in no way constitutes a solicitation of business or product advice. It is expressed solely as the opinion of the author, and as general information for the reader. It is not information to be relied upon in making investment decisions.

Why Transparency And A Well-Informed Strategy Are Crucial In Real Estate Debt

Recent industry and media dialogues have highlighted the importance of transparency in private debt fund management. Investors are increasingly seeking clear, comprehensive understanding of how investment decisions are made and what factors influence a portfolio selection.

To counter these concerns, I want to share some insights around how we manage risk and investment strategies, settings and decisions at Ark.

A commitment to investor-led strategies

Our approach as a strategic investment fund manager is to bring unique insights to the complexities and ever evolving challenges in private debt markets. We identify nuanced factors influencing performance in different markets, and act accordingly on behalf of our Investors.

We view these challenges not just as media-driven phenomena but as important signals highlighting the need for more sophisticated risk evaluation and strategic management approaches.

To maintain our investor-centric approach, we’ve developed a dynamic process of continuous planning, review and strategic assessment that ensures our investment decisions align precisely with our investor’s objectives.

This approach is particularly evident in our Bedrock fund, which strategically diversifies its investments across a broad number of loans with different borrowers across multiple sectors in specifically identified growth regions. This strategy helps us to optimise risk management whilst delivering strong returns.

To support our investment strategy and settings, we’ve established a strategic partnership with Urbis, a leading property-economics research firm. This collaboration enables us to conduct comprehensive, on-going assessments of geographies, markets and sectors we may target for our investments. While we publish detailed, bi-annual property outlook reports our approach involves continuous market intelligence gathering and analysis.

By continuously deepening our knowledge of market and industry trends and shifts, we strategically position ourselves to best identify and capitalise on the most compelling investment opportunities for our investors.

Transparency via regular updates and fact sheets for investors

One of the most important aspects of the work we do at Ark is supporting our investors to realise their wealth goals. We believe in complete transparency which is why we have developed and continue to refine our investor communications.

We choose to clearly articulate our investment strategy, to empower our investors by providing full visibility into their capital allocation. Through monthly performance updates and detailed fact sheets, complete with intuitive graphs and easy-to-digest insights, we give them a fully transparent view of their investments and their performance.

A clear strategy focusing on markets and sectors

This has also led us to develop a very clear strategy of focusing on markets and sectors where we see greater risk adjusted returns.

Here’s what this looks like in practice:

- A focus on Southeast Queensland, Adelaide and Perth, with a cautious approach to Melbourne and Sydney

- Opportunities in residential and industrial land, subdivision, and small scale built form industrial and childcare

- Shorter duration loan terms (average 12 months) and

- Conservative LVRs (currently average 62.7%).

Our combined approach of a well-informed strategy, and full transparency not only keeps us focused, it keeps our investors informed so they know exactly where their investments are going and how they’re performing.

If you would like to talk to us in more detail about our investment strategy settings and how we employ these through our funds, please get in touch.

Capital Protection 101: Getting The Most Out of Your Portfolio

In an ever-changing financial landscape, capital protection is at the forefront of savvy investors’ minds. While growth opportunities are important, safeguarding your investments should be a priority.

In this article, we explore how real estate debt can play a pivotal role in protecting your portfolio while still delivering robust returns.

Why capital protection matters?

Market volatility and economic uncertainty can erode the risk weighted value of traditional investments like equities. Real estate debt, on the other hand, offers an appealing alternative, blending steady income with mortgage-backed security. As an investment, real estate debt can reduce risk and provide a cushion during market downturns, a point highlighted by The Reserve Bank of Australia.

We’ve created robust risk assessment and management processes to keep your investments secure. It’s part of what has allowed us to achieve weighted average returns of greater than 10% p.a. across ~$1bn of investments throughout our ~10 year history.

How real estate debt works

Real estate debt involves lending funds to property developers or owners, secured against the development itself. This asset-backed approach ensures that even in adverse scenarios, your capital retains the protection of the underlying land and project value. According to CoreLogic, Australian real estate continues to demonstrate resilience, making it an attractive sector for investors prioritising security.

Balancing risk and reward

One of the key benefits of real estate debt is its ability to offer higher yields compared to traditional fixed-income securities, all while maintaining a lower risk profile by virtue of its being secured. As noted by The Australian Financial Review, the growth of Australia’s private credit market underscores the increasing demand for these tailored financial solutions.

Diversify for stability

Incorporating real estate debt into your portfolio is one way to achieve diversification, which can reduce overall risk exposure. Non-bank lending opportunities, in particular, provide streamlined access to this growing sector, as noted by Australian Broker News.

Secure your financial future

Real estate debt offers a balanced approach to capital protection and growth. Together, we can explore how this innovative investment can strengthen your portfolio while keeping your financial goals on track. Contact us today to learn more about how you can incorporate it into your portfolio.

Ark Capital: Our Rebranding Journey

We recently went through a rebranding process for a variety of reasons and we’re thrilled to share this journey with you. As with any change, it’s important to take stock of where we are so we can move forward with confidence and clarity.

A Brief history of Ark Capital

Since 2015, we’ve had the privilege of supporting both investors and borrowers in realising their wealth goals. The past decade has brought a tremendous amount of growth, innovation and success for Ark, which hasn’t been without its obstacles and challenges.

As we stand on the precipice of the next chapter, we’re poised to reflect on the journey and how far we’ve come. Here’s a snapshot of our history, funds, growth and trajectory as a business.

“

When we started out, it was baby steps.

The initial vision was to have $100M of FUM and grow from there, but the business has far exceeded my original expectations. We're now a matured business ready for the next phase.

Adrian Lee-Conway,

Ark’s Founder and head of the

Origination & Asset Management team

“

Why did we go through a rebrand?

Rebranding is more than just a fresh look, it’s an opportunity for us to evolve. It lets us shed outdated images and perceptions, engage with our current and new audiences in a meaningful way, and better reflect our current offerings and future direction. It allows us a chance to reaffirm our commitment to clarity, trust and thoughtful progress ensuring that we continue to meet the needs of those who engage with us.

As we evolve, our brand reflects our growth, innovation and renewed focus on our unwavering commitment to excellence. Our rebrand encapsulates who we are today and where we’re heading. We want it to resonate clearly with our current and future investors, partners and employees alike.

We've evolved as a business

As a business that’s been around for a little while now, our original brand identity doesn’t quite fit anymore, so it was time to change it. While our values remain true, the team and its goals have changed, so we needed a refreshed brand to move us forward.

We've expanded as a team

Our vision is to be the trusted partner in real estate investment and lending, delivering sustained growth and certainty for our clients. We do that through real estate expertise, a results-driven approach and personalised service. Our new brand encapsulates this subtle shift in direction while elevating our essence at the same time.

We're ready to grow even more

Put simply: we were ready to evolve. As a team, we’ve grown immensely in the last 5 years, and it wasn’t reflected in our old branding. The new branding helps to set us apart from our competitors and give us an edge in the market in a similar way to what we do for our clients.

But don’t worry – our business is still the same

Our rebrand updates and refreshes the ‘look and feel’ of the Ark brand, not how we do business. It won’t affect any investments or projects but rather shifts how we present our brand to the general public. Everything else behind the scenes remains the same and we’ll continue to deliver outstanding personalised services to our clients and partners.

We’re excited for what's to come next...

We appreciate you joining us on our rebranding journey and for sharing in the excitement of our new brand launch. To stay in the know with what’s happening at Ark Capital, make sure you sign up to our mailing list.

A Methodology-Driven Approach to Real Estate Investment

As an active real estate investment manager, we’ve built our investment strategy around a distinctive approach to market analysis. Rather than pursuing simple market timing, we focus on identifying whether a market is trending upward or downward across different regions and sectors. The crucial question isn’t whether market conditions are good or bad but whether they’re improving or deteriorating.

What is Ark’s investment methodology?

Ark’s methodology drives our investment decisions across our portfolio, which spans key market segments, primarily in;

- residential,

- commercial, and

- industrial assets.

To maintain current market intelligence, we operate a dedicated team that maintains an active presence in target markets, constantly analysing, and talking to the key stakeholders and market participants. This is supplemented by our research partnership with Urbis, producing bi-annual market outlooks that inform us of macro and micro factors that are impacting geographies, sectors and asset types.

For example, our approach to the Western Australian residential market illustrates this in action. In 2021, our research and on–the–ground presence helped us form the view that due to the factors of relative affordability, strong population growth, limited supply and a strong state economic base, we liked the residential land sector. We then made our first investment in early 2022, which has become one of our strongest land development deals, including being the fastest selling land subdivision in the Ark book. We have since made two further investments in the WA market, both supported by these ongoing strong fundamentals.

Recent market conditions

Our analysis of the Australian residential market identified divergent opportunities across regions, with Southeast Queensland, Adelaide and Perth showing strong growth patterns while Sydney remained flat, and Melbourne experienced negative growth.

The Melbourne market has proven particularly instructive. Despite positive fundamentals including strong population growth and restricted supply, the market has faced headwinds from government policy, taxation settings and declining consumer confidence.

Meanwhile, Southeast Queensland has benefited from affordability advantages and strong economic fundamentals with additional momentum in the lead up to the 2032 Olympics.

Over the last 2-4 years, we’ve had a strong appetite for good quality residential land investments in Brisbane, Adelaide and Western Australia. These markets have proven our investment thesis correct, with these investments generally delivering on or ahead of program and on or above investment returns.

For every opportunity, we ask ourselves: are conditions getting better or worse in this market? This question drives not only investment decisions but also how individual investments are structured. As market conditions continue to evolve, we will continue to apply our methodology driven approach to market analysis.

Better investment decisions start with better insights

We believe the best investment decisions are built on insight, not instinct. If you’re curious about how to navigate the complexities of real estate investment across changing market cycles, we’d love to connect. Get in touch to learn how you can achieve stronger more resilient returns.